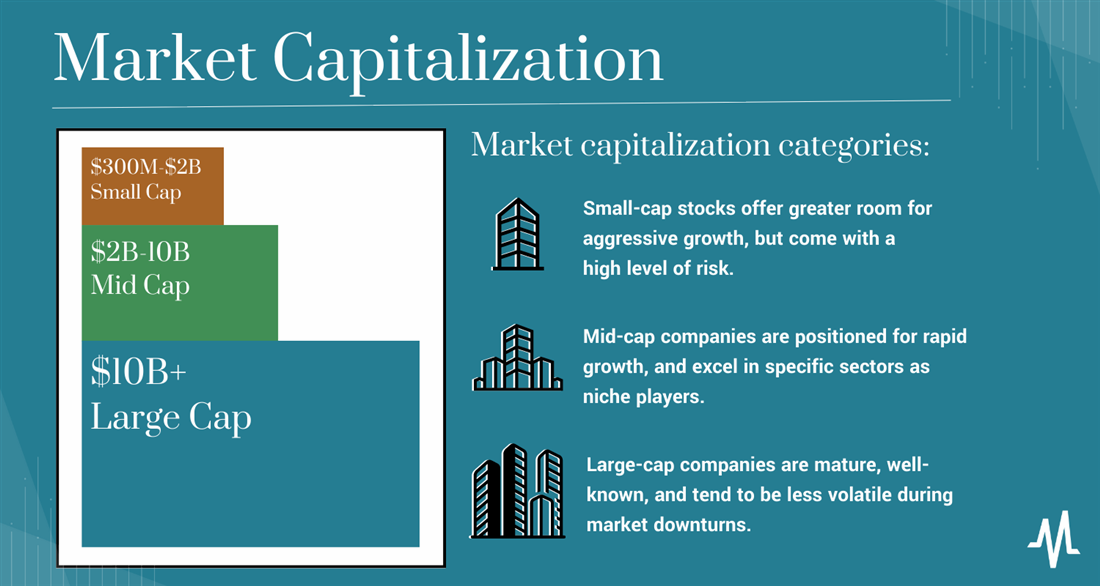

These stocks have a relatively low market cap (less than $2 billion). Analysts won’t debate that small-cap stocks have outperformed large-cap stocks over time. However, that requires you to have the patience to hold onto these stocks during times of volatility. They offer greater room for aggressive growth, but with that opportunity for reward comes a high level of risk.

Market Capitalization: What it Means for

Key Points

- Market capitalization is a tool you can use to invest well and reach your financial goals.

- Market capitalization is the total value of a company’s outstanding shares, determined by multiplying the current market price of a company’s stock by the total number of shares issued.

- Generally, large-cap stocks are seen as less risky investments, while small-cap stocks tend to be riskier but offer greater potential returns.

If you want to increase your portfolio profits, there’s no more important concept than market capitalization. Often referred to as “market cap,” market capitalization helps you determine the size and value of companies and their respective stocks.

After reading this article and understanding the basics of market capitalization meaning, you’ll be able to make more informed financial decisions and protect your investments.

If you want to increase your portfolio profits, there’s no more important concept than market capitalization. Often referred to as “market cap,” market capitalization helps you determine the size and value of companies and their respective stocks.

After reading this article and understanding the basics of market capitalization meaning, you’ll be able to make more informed financial decisions and protect your investments.

What is Market Capitalization?

There are three broad market cap categories: large, mid and small. Generally, a company has a large market cap if it is over $10 billion. Mid-cap companies have a market cap between $2 and $10 billion, and small-cap companies have a market cap of less than $2 billion. There are other designations like micro caps (beneath small caps) or ultra caps (above large caps), but we’ll stick with these three categories for this article.

Large-Cap Companies

Large-cap companies, with a market capitalization of over $10 billion, are mature and well-known. They may not have the same growth potential as smaller companies, but they provide dividends to investors and are more likely to increase in value over time. These stocks also tend to be less volatile during market downturns.

Mid-Cap Companies

Mid-cap companies have a market cap between $2 billion and $10 billion and are positioned for rapid growth, making them less risky than small caps but riskier than large caps. They excel in specific sectors as niche players, offering a balance of growth and stability.

Small-Cap Companies

How to Calculate Market Cap

Calculating how to find market cap is relatively straightforward. If you’re wondering how to calculate market cap, just multiply the number of outstanding shares of a company by the current stock price to define market capitalization. For example, let’s say a company has 10 million outstanding shares and its current stock price is $50.

The calculation for this would be 10 million x $50 = $500 million. Therefore, this company has a market cap of $500 million.

Remember that if the number of outstanding shares or the stock price changes over time, the market cap will also change. Pay attention to these numbers over time to track a company’s market capitalization and assess its value.

What Makes a Company’s Market Cap Increase?

Since market capitalization is based on the volume of outstanding shares and the price per share, changing either will cause a market cap to rise or drop. The most obvious way a company’s market capitalization can increase is to increase its stock’s value (i.e., for its price per share to rise). This essentially means a company meets or exceeds performance expectations and is rewarded by having investors want to buy shares of their company, which in turn drives up the price of each share.

A second way is for a company to issue more shares. This is typically done because the company wants to raise capital. At first, investors may see a slight dilution in share price as more shares go on the market, but the market cap would still increase unless the share price took a big hit for another reason.

What Makes a Company’s Market Cap Decrease?

Using the same two variables of price per share and volume of outstanding shares, let’s look at how a company’s market cap could decrease. First, their shares lose value. This means the company did not meet performance expectations which may cause investors to sell, which drives the price per share down. While nobody likes to see the price of a share decrease, you may know that this is a normal part of investing and can use these dips to add more shares which can increase the value of their portfolio should the market rebound.

A company’s market cap can decrease if its share price drops or it buys back some of its outstanding shares. For example, a company with one million outstanding shares worth $50 each has a market cap of $50 million.

If it buys back 100,000 shares, its new market cap is 900,000 x $50 = $45 million. However, the actual effect on the market cap may be less since a company buying back shares hopes for an increase in the stock price. Occasionally, a company may buy back some of its outstanding shares to improve shareholder value or earnings per share (EPS) ratios.

The increase in market capitalization shows how influential individual investors can be in the stock market when they choose to buy or sell stocks. Even if you only buy a few hundred or thousand shares of a company, it could still affect its overall market capitalization and impact the entire stock market.

What Does Market Capitalization Mean for Investors?

The definition of market capitalization is one way investors measure the value of a company in the stock market. Company A may have one million shares selling at $100 each ($100 million market cap), whereas Company B might have 10 million shares selling at $80 each ($800 million market cap).

Though Company B is larger, its price per share is lower. The value of a company also involves other factors not readily apparent — just like with professional sports, where a player’s worth to a team can exceed their expensive contract. Similarly, in investing, the market sets a stock’s price and affects the company’s market cap.

How to Invest Based on Market Cap

Consider a company’s market capitalization when making stock buy decisions, since a company’s market cap can indicate growth potential. Generally, large-cap stocks are seen as less risky investments, while small-cap stocks tend to be riskier but offer greater potential returns. Mid-cap stocks offer a balance of the two.

As an investor, you should have all three types of stocks in your portfolio for better diversification and growth potential. To measure the returns of a stock, use the S&P 500 index for large-cap stocks, S&P Midcap 400 index for mid-caps and either the S&P SmallCap 60 or Russell 2000 indices for small-cap stocks. Additionally, many mutual fund companies have funds that specifically invest in the same market capitalization stocks to aid you in further diversification.

Always try to clearly understand the meaning of market capitalization and its implications before investing. By learning the basics of the market capitalization formula, you can make wise decisions and maximize profits.

Step 1: Research analyst ratings.

Analysts’ ratings, such as buy/hold/sell, guide investors looking to make decisions based on market cap. Analysts assess a company’s stock by considering its market capitalization, financial performance, news reports related to the company and higher-level economic trends. It’s smart to consider analysts’ ratings when making investment decisions, since they can access more data than you do as an individual investor.

Step 2: Monitor market trends.

Stay aware of trends in the overall financial markets and their potential impact on an individual company’s stock price. Watch out for any sudden movements in an industry or sector that could affect its value.

For example, if there’s news of an oil spill that affects the entire oil industry, then some companies’ stocks could go up while others might go down quickly.

Step 3: Consider different types of stocks.

When investing based on market capitalization, consider different types of stocks (e.g., value stocks vs growth stocks). Each type has its advantages and disadvantages. For example, small-cap value stocks typically offer more potential upside than large-cap growth stocks but may also involve greater risk due to their lack of liquidity.

Understand Market Capitalization

Understanding market capitalization is vital to good investing. By researching and monitoring the news, you can formulate a strategy based on your risk tolerance and get your desired returns. You can also ensure that your portfolio is well-diversified and free from unnecessary risks. The key takeaway here is that there’s no one right way to invest based on market cap — every investor has to take the time to develop a strategy that works.

FAQs

Have a good idea of what market capitalization is and what it means for you as an investor? Even if you do, you might still have some outstanding questions. Check out our FAQs below.

What does market capitalization indicate?

Market capitalization indicates the size and value of a company and its stock. It represents the total market value of a company’s outstanding shares, which we calculate by multiplying the number of outstanding shares by the current price per share. Market capitalization typically classifies companies into different categories (large cap, mid cap and small cap).

Is it better to have a high or low market capitalization?

Market capitalization is a key metric in evaluating the potential value of a company and serves as an indicator of how much risk you might take on by investing in it. Generally speaking, high market cap stocks are less risky than low market cap stocks due to their larger size and scale; however, this doesn’t necessarily mean that they’ll always outperform smaller companies with lower market caps. Ultimately, it comes down to understanding the individual dynamics of each individual company and assessing its potential for growth or decline over time.

What is the difference between market value and market capitalization?

Market value is the price of a company’s stock, based on supply and demand as determined by stock market trading. Market capitalization is the total value of a company’s outstanding shares, calculated by multiplying the number of outstanding shares by the current price per share. These two terms are closely related — a company’s market capitalization gives investors an indication of how much they would have to pay to buy all of its outstanding shares at any given time. Generally speaking, companies with higher market caps tend to be larger and more established than those with smaller market caps.