How to be financially prepared for care in old age

In simpler times, when people got too old to are for themselves, they might have moved in with their adult children – if they didn’t already live together. That’s more difficult in today’s mobile society; likely as not, your grown kids don’t live near you. And modern geriatric care, while inarguably better is more live complex than in days past, so chances are good that, someday, you will need professional help.

In simpler times, when people got too old to are for themselves, they might have moved in with their adult children – if they didn’t already live together. That’s more difficult in today’s mobile society; likely as not, your grown kids don’t live near you. And modern geriatric care, while inarguably better is more live complex than in days past, so chances are good that, someday, you will need professional help.

In fact, the majority of older Americans will need some form of custodial care 0 70% of people over age 65, according to government data. That help could be minimal, such as occasional outpatient day care, or more comprehensive like full-time residency in a nursing home.

If you wait until you are in your 60’s to buy long-term care insurance, the cost will be much higher.

Long-term care is expensive and getting more so because its labor intensive. The average cost of a private room at a nursing home is $9,034 per month, or about $108,000 a year, none of which is covered by Medicare if long-term custodial care is what you need. Even cheaper services like in-home assurance can drain your nest egg quickly. As a result, it can make sense to plan ahead and buy insurance for long-term care.

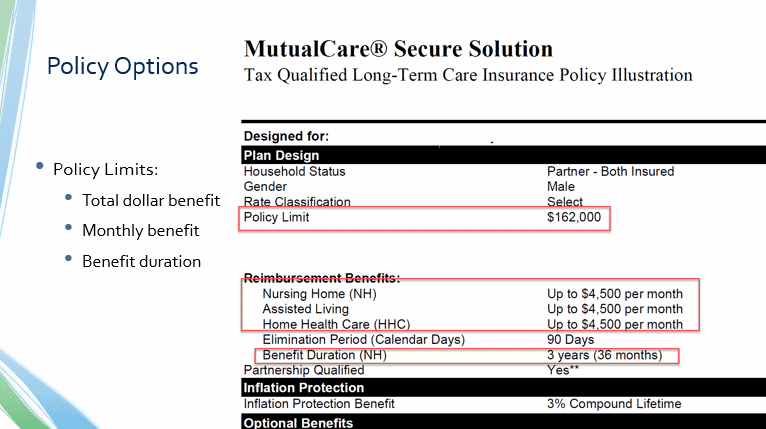

Long-term care insurance is costly, but it will be cheaper if you sign up when you are still young and healthy – generally in your mid-50’s, which is when experts recommend getting a policy. For example, in 2022, the average 55-year-old man paid on average, $950 a year for relatively minimal coverage of $165,000 (adjusted upward annually by 3%) the average woman paid more – $1500 – because women’s life pans tend to be longer than men’s. like other types of insurance, premiums can rise every year as the cost of care increases, although generally hikes require approval by state regulators.

If you wait until you are in your 60’s to buy long term care insurance, the cost will be much higher. If you seek insurance when you already have symptoms (such as dementia onset or difficulty performing daily activities), you may be turned down by insurance companies.

Shopping for Insurance

Long-term care insurance comes in may flavors. There are policies only for adult day care, and others that pay all nursing home expenses. Many have daily expense limits, which can vary a lot. Some require you to stay in partner facilities, limiting your choices. Some carry inflation adjustments while others don’t. Some will cover you and your spouse; other plans are strictly individual. So, make sure you do a thorough search before signing on.