There are a number of factors that affect your Social Security benefits, and your salary is just one of them. It’s important to note that your benefit amount is not based on your last year or two in the workforce but on your lifetime earnings, so even if you made a lot of money in your most recent pre-retirement years, you might not get the maximum benefit amount.

How Social Security Benefits Are Calculated

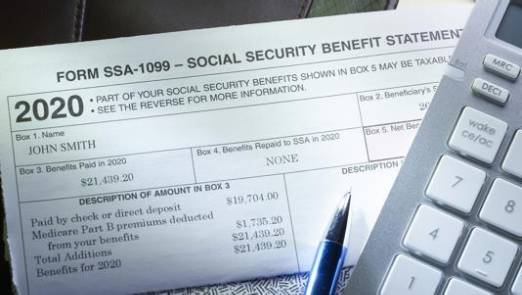

The Social Security Administration calculates your benefit amount by considering your lifetime earnings and then adjusting actual earnings to account for changes in the average wages since the year earnings were received. Your benefit is based upon the adjusted average monthly earnings during the 35 years in which you earned the most.

This average is plugged into a formula to find the “primary insurance amount” — the benefit amount you would receive at your full retirement age.

What Salary Is Needed To Receive the Maximum Benefit?

In 2024, $168,600 is the salary needed to receive the maximum benefit. The Social Security Administration takes your 35 highest-earning years and averages them (adjusted for inflation) to determine your benefit. If, via this calculation, you have paid the taxable maximum over this time span, you may be eligible for the maximum benefit.

What Is the Maximum Social Security Benefit?

The maximum benefit depends on the age you retire. If you retire at your full retirement age in 2024 (66-67, depending on the year you were born), your maximum benefit would be $3,822. However, if you retire at age 62, your maximum benefit would be $2,710. If you retire at age 70, your maximum benefit would be $4,873.