How to Cover the high cost of medications

Most Americans in retirement rely at least in part on Medicare to pay for many of their health care expenses, including prescription medications. But Medicare doesn’t cover everything, and early retirees who aren’t yet eligible for Medicare will need other options to pay for prescription drugs. Here’s what you need to know about paying for prescriptions in retirement, with or without Medicare coverage.

If you have Medicare

Medicare has four parts, which offer different coverage. Medicare Part D covers medications, while Parts A and B cover hospital stays and doctor’s visits. Those enrolled in Part D pay a monthly premium and a copay or a cost-sharing portion for prescriptions. Ther are a number of options to choose from, each with a different price and list of overed drugs. The average monthly premium for a Part D plan, is about $31.50 in 2023. To find out more about Part D options, visit medicare.gov/find-a-plan. Be sure to check the list of covered drugs under the plans you’re considering to make sure your medications are covered and see how much you can expect to pay.

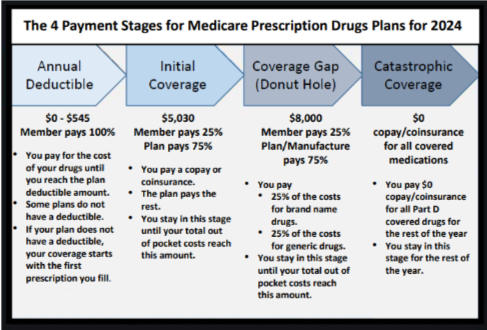

The Medicare Coverage Gap

If you get prescription drug coverage through Medicare Part D, you must understand the gap in coverage known as the “donut hole.” If your prescriptions costs are below a certain threshold ($4,600 in 2023), some of your cost’s wok be covered, toy wok be rescissible fir cists above tag knot, Medicare beneficiaries receive a 75% “donut hole discount” on brand-name drugs until the reach the outfoot pocket annual limit” is reached, your Part D drug plan will fully cover the costs of your prescriptions.

Options for Paying for Medicare Part D

Low-income Medicare beneficiaries within a certain income category may be eligible for Medicare’s Extra Help program. This program applies to those with an annual income in 2022 of less than $20,385 for individuals and $27,465 for married couples. These limits may change in 2023.

Another option is a Medicare Advantage plan. Also known as Medicare Part C. these plans are offered by private insurers and lump Medicare Parts A, B and D together into one comprehensive plan package. In some cases, this may be a more affordable options than enrolling in Parts and B and paying an additional Part D premium.

If You Don’t Have Medicare

If you are younger than 65 and not yet eligible for Medicare, you’ll need to consider other options. Some companies will extend health benefits to retirees for a period of time. Or you may be able to join your spouse’s health coverage through an employer. Plans are also available through either a health care exchange in your state or the federal exchange at healthcare.gov. (your life)