Avoid the 10 Worst Investments Ever with These Smarter Alternatives

There’s is lots of competition for the worst investments ever, including penny stocks, buying a home and time shares.

Contents

There’s is lots of competition for the worst investments ever, including penny stocks, buying a home and time shares.

Contents

1. Timeshares

2. Race horses

3. Restaurants

4. Penny stocks

5. Company stock

6. Buying a house beyond your means

7. Staying invested in all cash

8. Home improvement tools

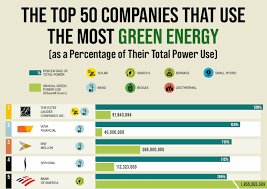

9. Green companies

10. Investments in anything you don’t understand

Final ghoulish thoughts

We have compiled a haunting, nightmarish list of the worst investments you could ever make. It’s a graveyard of horrors ready to suck the life right out of your money.

But don’t let it spook you too much because we also offer some investment alternatives to offset this spine-tingling list of horrors.

Chin up, but proceed with caution:

1. Timeshares

You know the pitch: Listen to our 90-minute presentation in exchange for a free weekend for two at our luxury resort.

If you take the bait and purchase a timeshare, you should turn as white as a ghost.

Why?

Let’s say, that condo you get to enjoy for one week each year into perpetuity costs you $20,000.

If, however, that unit is sold 51 more times, accounting for the 52 weeks there are in a year, the sellers are placing its value at a little over a million dollars (20,000 x 52 = $1,040,000).

The real horror is, your unit might truly be worth only $200,000, and that’s before calculating yearly maintenance costs.

Instead, try:

Conservatively investing the money in a 5-year CD at 2.35 percent, leaving you a total of $22,463.08 after five years. That’s a much shorter time horizon, and the money remains all yours rather than having it tied up for life in a condo you get to access

one week out of the year.

2. Race horses

Race horses are fast, but they’ll drain your financial resources even faster.

After purchasing a thoroughbred, you have to board, train, shod, groom, hot-walk, medicate, and feed it, not to mention, find a jockey to ride it before your half-ton steed ever makes it onto the racetrack.

That’s about a $60,000 tab a year.

One bloodstock agent (a seller of horses) estimated that for every $100 you invest in a horse, expect to lose $79.

Race horses are fast, but they’ll drain your financial resources even faster.

After purchasing a thoroughbred, you have to board, train, shod, groom, hot-walk, medicate, and feed it, not to mention, find a jockey to ride it before your half-ton steed ever makes it onto the racetrack.

That’s about a $60,000 tab a year.

One bloodstock agent (a seller of horses) estimated that for every $100 you invest in a horse, expect to lose $79.

In other words, for every $100 you lay out, you’re only going to see $21 in return.

You would be better off plunking your money down on the favorite in each race, which win about one of every three races. That said, if you’ve got money to blow, what could be more fun than hanging out with your pals at the track and hanging on to a dream that your horse will be the next Secretariat.

Instead, try:

Putting your money in the stock market, which some critics say is another form of gambling.

The S&P Index of 500 stocks, however, has returned about 18 percent over the last years, so if you invested the same $100,000 you would have invested in a horse ($60,000 for maintenance, $40,000 to purchase), you would have $118,000 at the end of one year.

That buys a lot of hay and is far better return than being left with $21,000 for your $100,000.

3. Restaurants

Restaurants, like horses, are another longshot.

To start your own, you need to be far more than just a good cook, or even a great cook.

In fact, cooking has little to do with restaurant success.

You have to be able to manage and juggle all kinds of moving parts, including the lease, pricing, spoilage, the wait staff, vendors, permits, location, marketing … there are probably more problems to worry about owning and running a successful restaurant than there are spices in your spice rack.

The failure rate is so great that Gordon Ramsay made peeking into restaurant kitchens a worldwide television obsession for a dozen years.

Although there’s the myth that about 90 percent of all restaurants go down the toilet in the first year, research shows it more like 60 percent.

Regardless, the statistics are scary, which is why so many investors find other partners to invest with.

That doesn’t make the problems go away or the need to hire a stellar no-nonsense manager who is the financial equivalent of celebrity chef Bobby Flay any less dire.

Yes, if you own a partnership in a restaurant, you might get a better table than most, but at the minimum entry price of $25,000, you could get a lot of nice tables without a headache.

In the 1970s, Burt Reynolds, then the world’s most popular movie star, invested in a restaurant chain called PoFolks.

After opening several outlets in California, Texas, and Florida, he was the poorer for it, dropping about $15 million before his investment dalliance drove him into bankruptcy in 1996.

Instead, try:

Putting your money in a basket of restaurant stocks.

You’ll own companies like Chili’s, Olive Garden, Red Lobster, Applebee’s and other mainstream eateries, but ownership and the investment returns won’t be nearly as volatile.

If you don’t find backing, restaurants that push unlimited breadsticks all that appealing, contribute more to your IRA or 401(k).

4. Penny stocks

A penny stock is a loose term for any stock that is not a blue-chip stock.

Some consider a penny stock any stock valued under $5, for others, the threshold is $3 or even $1.

The reason people buy them is they think they’re going to discover the next Walmart or Microsoft on the cheap.

The problem with these stocks is they are loosely regulated, lack track records and histories, and are highly illiquid, meaning they’re hard to trade.

Their promoters, working in boiler-room operations (think “The Wolf of Wall Street”) pump up the stocks before dumping them.

This pump-and-dump strategy will often catch buyers holding a bag of worthless securities.

Instead, try:

Rolling up your pennies in those little brown coin wrappers and opening up a safe savings account.

With today’s low rates, your return will be minimal, but at least you won’t be holding an empty bag for your troubles.

5. Company stock

What better way to express your loyalty to your company than purchasing its stock.

But buyer beware.

The fortunes, or lack of them, could take you on a wild ride.

Look what happened to Aubrey McClendon, former chief executive of Chesapeake Energy Corp., who tied up most of his personal fortune in his company’s stock.

That’s one of the reasons he’s no longer chairman, although he founded the company.

In 2008, McClendon was worth about $3 billion, based on his Chesapeake holdings, which traded at about $60 a share in 2008.

As of 2014, Chesapeake was listed at about $22 a share. It’s estimated McClendon’s net worth took a $2 billion bath.

Instead try:

Investing in a portfolio of assets.

This way you spread your wealth around. If anyone sector gets whacked, another sector you own will probably move in the opposite direction.

Take oil stocks, for example.

There’s a glut on the market currently, so if you owned them exclusively, you would be hurting financially.

But if you also owned airline stocks, that portion of your portfolio would be taking off because of low fuel prices, airlines’ biggest expense. Diversify!

6. Buying a house beyond your means

Buying a house is a notion that’s hard to resist because it’s an idea intertwined with the American Dream and having it all.

But what you’ll have, if you get in over your head, is a house sucking up a lot of your disposable income in the form of a down payment, monthly mortgage payments, insurance, taxes and maintenance costs.

Regarding the latter cost, Ilyce Glink, author of “100 Questions Every Homeowner Should Ask,” says that homeowners should expect to spend between $2,000 and $10,000 annually on home repairs.

If you live in your home an average of seven years before upsizing or downsizing, potentially investing another $70,000, you may or may not recover the cost of your repairs and improvements.

Not everyone will give you fair value for the polka-dot wallpaper you plastered all over the master bedroom.

Instead, try:

Renting longer unless the deal of the century comes your way. You’ll be more mobile, incur fewer if any “improvement” costs, and you can invest all that upfront money, which would have gone to a down payment, furnishings, and improvements, in CDs.

Ladder your CDs by purchasing short-term and long-term products, which will help you earn higher interest while still giving you access to your money.

7. Staying invested in all cash

Staying in all cash is the equivalent of digging your own grave.

You’ll end up with zombie money. Okay, it won’t be exactly dead money, but it’ll be close.

If you need an illustration, use the Bureau of Labor Statistics inflation calculator to learn the grim truth about how inflation can eat away the value of your money and turn it into a living corpse.

Let’s say you had $100,000 in 2000 to buy a place by the Colorado River so you could indulge your weekend warrior passion of jet skiing.

That same identical place in 2014 would cost you $138,229. By just sitting in all cash, you just came up $38,229 short.

Instead, try: Putting money in investment or savings accounts that produce yields at least equivalent with inflation.

8. Home improvement tools

Staying in all cash is the equivalent of digging your own grave.

You’ll end up with zombie money. Okay, it won’t be exactly dead money, but it’ll be close.

Instead, try:

Renting these home improvement tools from Home Depot or a rental yard listed by the American Rental Association.

They might even show you how to properly use what you’re renting.

Plus, Home Depot has half-day rentals, where you can check out the equipment at night and have it back by 9 a.m.

This is a good move if you’re a night-owl DIYer.

9. Green companies

We’re talking about the other kind of green company — the exploding marijuana industry.

Is it a good business? Absolutely.

Consider the mind-bending ride Medbox (MDBX) sent its investors on.

The company’s stock, which makes automated dispensing solutions for medications and marijuana, shot up from $8 on Dec. 18, 2013 to $93 on Jan. 8.

You would have thought the company had just discovered a cure for cancer.

On Oct. 22, 2014, the stock was priced at $10.85, which could have turned you white as a sheet, if you had ridden the stock all the way into the 90s.

While the business offers great investment potential, recreational use of pot is still legal in only Colorado and Washington.

The Feds could come in and shut down illegal use in all 48 other states.

That’s too much haze for this investor.

Instead, try:

Investing in existing tobacco companies.

Should pot be accepted nationwide, the big tobacco companies can be counted on to scale up distribution and score big profits.

If you don’t like endorsing tobacco companies, investigate other so-called “sin” stocks peddling beer wine and spirits.

Then again, you could just play it straight and purchase a CD.

10. Investments in anything you don’t understand

Many people still don’t know what caused the Great Recession, but chances are they’ve heard words such as “swaps,” “derivatives,” “collateralized,” and “structured,” associated with the great collapse.

As for playing the stock market, if you don’t know the difference between a stop and stop limit order or the difference between an in the money option and out of the money option, then simply stay away from these confusing investments.

Instead, try:

Returning to your brick and mortar or online bank and keeping your money in savings and CDs, where the principle of compounded interest, described as the eighth wonder of the world, can still work its magic.

Final ghoulish thoughts

We understand why people continually chase alternative investments outside of traditional savings and CD accounts.

When a one-year Treasury Bill is listed for a tenth of one percent, you feel compelled to chase higher yields that at least will keep pace with inflation.

While it’s certainly exciting to cash in on a great investment, the big splashes you hear about are as rare as $3 bills and far less (Mr.) wonderful than you think.

The current ABC hit show, “Shark Tank,” is symptomatic of our times.

It scores big with audiences who want to invest in the next big thing, successes that the show celebrates from time in their “Let’s see how they’re doing now” flashbacks.

But like the degenerate gambler who only tells you about his big days, you don’t hear much about the failures or worst investments ever, which are far more numerous than the winners.