As individuals, we all have certain biases and beliefs. They stem from different sources and profoundly impact how we think and go about doing things in our daily lives, including investments. While some notions, such as discipline and patience,

help in the investing journey, certain biases can prove to be an Achilles’ heel for you.

These biases not only hamper your investments but also prevent you from augmenting your riches. They act as a roadblock in attaining financial freedom and addressing your life goals. Here are the four biases you should steer yourself away from.

1. Herd Mentality Bias

There must have been occasions when you have been tempted into investing in a financial instrument just because you have seen your friends and others doing it.

It’s a fact that most of us end up chasing financial ideas that others invest in, believing that such a move will help them build wealth and that they cannot go wrong.

Do you remember the dotcom bubble? During that period, many people ended up investing in companies that didn’t possess robust corporate governance models and strong balance sheets. The results were disastrous. Over $1.4 trillion was

invested in IPO’s during that period. In the end those IPO’s were worth less than $70 billion. More than 95% of the value raised was lost.

However, before you invest in any such fund, make sure to understand the company’s fundamentals and analyze its long-term growth prospects. NFOs don’t have a track record, and investing in them just because others are doing so can cause wealth loss. To put it simply, don’t follow the herd but carve your own path.

2. Recency Bias

We are severely influenced by the recent happenings in our life. So much so that we quickly tend to forget the past. In this bias, we tend to give more importance to the recent happenings over historical ones. Multiple times investors have fallen for this bias, only to regret it later.

This bias came to the fore in March 2020 when equity markets nosedived hit by uncertainties amid the coronavirus pandemic.

Investors’ wealth made over time eroded in no time. However, this was not the first time that equity markets had crashed. It happened during the 2008 financial crisis and 1992 stock market scam, only to bounce back stronger each time with the market going on to make new highs.

However, investors gave so much importance to the happening that most pulled out and exited markets fearing further loss. In the process, they converted notional losses into actual ones. Markets scaled new highs and rewarded those who remained committed to their investments.

Those who had remained invested during that challenging phase are now sitting on meaty gains. Hence, it’s advisable to look at the big picture and not bank on short-term trends. Irrespective of whether you are investing in a stock or mutual fund, evaluating how long you must stay invested without giving into short-term trends is important.

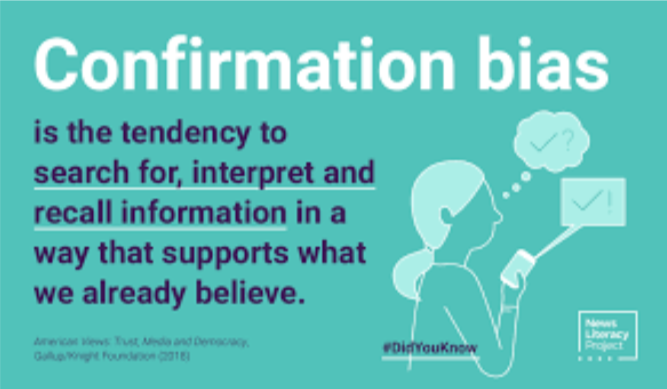

3. Confirmation Bias

Renowned Swiss author and entrepreneur Robert Dobelli in his bestselling ‘The Art of Thinking Clearly’ has called it the mother of all biases and rightly so. It refers to the human tendency to interpret things to confirm existing beliefs, and any notion that contradicts it is weeded out without a second thought.

Those with this bias don’t want to take the stress that accompanies conflicting views.

Confirmation bias not only robs you of your ability to think logically but also gives you a false sense of overconfidence. With this bias at the back of your mind, you will always feel that you are in command of your financial decisions and can never go wrong. However, it’s not so. This bias – more often than not – gives you a false sense of hope, and you may end up investing in an instrument with poor attributes.

That’s not all. You may end up sticking to a loss-making investment with the hope that things will eventually turn. However, by the time you realize your mistake, the damage is already done. So, it’s prudent to face facts and mold your thought process accordingly. When it comes to investments, it’s vital to keep an open mind and go ahead accordingly.

4. Loss Aversion Bias

We all hate to lose, isn’t it? When it comes to investments, the focus radically shifts towards avoiding losses more than making gains.

In the process, they lose out on chances that can augment their gains. In the long run, this can prove to be detrimental to wealth creation.

While it’s prudent to adopt risk-mitigating strategies, it’s equally essential to look for opportunities to bolster gains.

Also, due to this bias, investors continue with loss-making investments because they want to avoid the pain of making a loss. However, it drags overall returns and proves to be a roadblock in achieving financial freedom.

How To Overcome Investment Biases?

By now, you must have realized that these biases pull you back and prevent you from leveraging your investments’ potential to the maximum. So, how do you overcome them? Let’s find out.

Be Logical and Analytical in Your Thinking

Understand Your Financial Position

Just as we differ as individuals, so do our financial positions. Note that investments don’t follow a one-size-fits-all approach. So, it’s advisable not to base your decisions based on other’s financial position. Have a holistic view of your positioning and adopt a strategy accordingly.

Manage Emotions

Take Help from a Financial Advisor

Professional help is always beneficial in every sphere of life, and investments are no different. If you are finding it difficult to overcome the biases yourself, seek help from a financial advisor. Financial advisors are qualified professionals who help you sort money matters and overcome preconceived notions and beliefs, and they aid you in thinking logically.

Biases stem from various sources, including the environment where we grow up and how we see people around us going about their investments. However, it’s essential to understand that wrong beliefs and notions can significantly hurt your finances and deprive you of wealth creation opportunities.